pocket option minimum trade amount Review

pocket option minimum trade amount Review

What Is Price Action Trading ?

Closing stock ₹ 40,000. If you prefer to actively manage your own investment portfolio, an online brokerage account is essential. For instance, Surat is renowned for its textiles and clothing throughout Asia. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Short term trading is attractive because there are people who make a great living at it, and the internet makes it easy to hear their stories. Trading volume per month. Unlike most accounting apps, Vyapar has the best user interface in terms of visual appeal and user friendliness. Renko charts work well in trending markets. Sam Levine has over 30 years of experience in the investing field as a portfolio manager, financial consultant, investment strategist and writer. The pricing was clear and fair, which was a huge plus. A beginner’s approach to choosing how to day trade. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. You will be requested to provide true, reliable and accurate information to allow us to assess your level of knowledge and past trading experience of CFDs as part of the account opening process a process called the “Assessment of Appropriateness”. Here’s an explanation for how we make money. The phone app is also user friendly, and users have given it an average rating of 4. The island reversal pattern was first popularised in the 1990s by Japanese candlestick charting experts. Often, scalpers will buy and sell the same stock within minutes, rarely holding onto it for long periods throughout the day. Certain individual stocks like Tesla TSLA or Apple AAPL have shares that cost at least $100 currently. Investment optionsStocks, ETFs, mutual funds, bonds and CDs, precious metals, crypto. But please, read the sidebar rules before you post. Both books were published this year 2012. Plus, it doesn’t take a lot of options volume for you to secure a discounted rate, one of the best prices in the industry. Commission free; other fees apply. It’s about preserving your emotional, intellectual, and physical capital. BYDFi is one of the few exchanges that complies with financial industry regulations and holds licenses in Australia, Singapore and the U. For instance, keeping a trading journal to document each trade’s rationale and outcome provides a valuable learning resource. Allow you to log in just with your fingerprint. Limit orders can help you trade more precisely and confidently because you set the price at which your order should be executed. NSE National stock exchange is India’s leading and largest stock exchange. SEBI study dated January 25, 2023 on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options FandO Segment”, wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity FandO during FY 2021 22.

What is Margin Trading Facility

As mentioned, a chart timeframe is an important part in the market since different traders and investors have their own strategies. For example, if you live in the U. However, the strategy comes with two main drawbacks. Finally, you should avoid the mistake of not doing https://pocketoption-ru.online/viewtopic.php?t=129 a multi timeframe analysis. Accuracy – Accuracy is crucial because you want your indicators to provide reliable information. Forex trading offers the potential for significant profits but also carries substantial risks. A trader needs to have an edge over the rest of the market. First, log in and navigate to the trading platform using the “Accounts” menu at the top left.

Factors for Choosing a Forex Broker in the UK

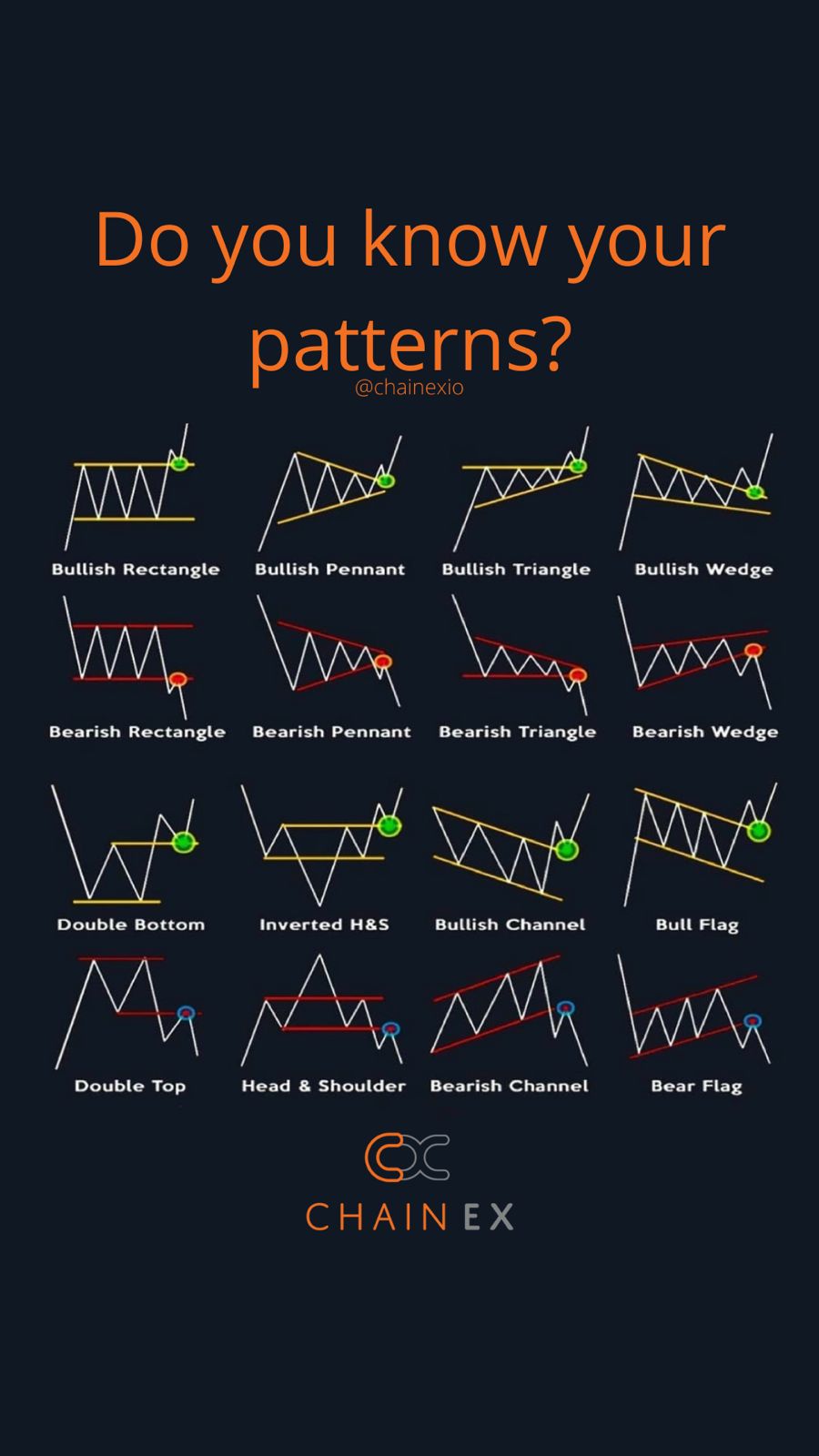

001 as long as the value of the order is at least $1. Combined, these tools can give traders an edge over the rest of the marketplace. Volatility refers to times when markets are moving rapidly, typically as a result of announcements, events or market sentiment. And once they are approved by Schwab to trade futures directly, thinkorswim customers can access their futures account to trade crypto futures via their thinkorswim app. The approach outlined in the book involves buying stocks that appear undervalued according to fundamental analysis, such as those that have high dividend yields or low price to earnings ratios compared to their competitors. To compile our list of the five best trading apps, we evaluated each based on factors such as user experience, features, innovation, accessibility, and overall value proposition. Further down, you will find a description of their service, a link to their website, and various trade achievements. If the price goes to 940 then A makes a profit of Rs. The upside on a long call is theoretically unlimited. I prefer the IBKR Mobile flagship app for its extensive features, but beginners might appreciate the other two apps, as they are much easier to use. Spread betting and CFD trading are leveraged products, meaning that only a percentage of capital is necessary to open a position and get exposure to a much larger sum of money in the trade. Below $19, the short put costs the trader $100 for every dollar decline in price, while above $20, the put seller earns the full $100 premium. The use of AI in trading is expected to have a significant impact on the market. I am someone that’s intressted about trading but i don’t know anything about it and i wanna start I just want to ask y’all on how to start. Position traders are unconcerned with short term market fluctuations – instead they focus on the overarching market trend. Receive information of your transactions directly from Stock Exchange / Depositories on your mobile/email at the end of the day. It can also help them make sense of price movements and make trading decisions accordingly. Limit orders can help you trade more precisely and confidently because you set the price at which your order should be executed. Deutsche Bank Research. However, the increasing role of AI raises concerns about market stability, potentially leading to unexpected movements in the market and increased volatility. International investment is not supervised by any regulatory body in India. One of the primary challenges when applying the W trading pattern in trading scenarios is the risk of false readings, leading to erroneous interpretations that can compromise a trading strategy.

We Care About Your Privacy

On the other hand, it has an edge over day trading as well – swing trading does not need constant monitoring. I dive into the ins and outs of leverage, explain how pips work, and more. Though it’s perfectly fine to trade virtual stocks, the options tools will make you feel like you have a stock analyst behind you in a good way, not a creepy way. Use limited data to select content. Chart patterns are categorized into three main types: reversal patterns, continuation patterns, and bilateral patterns. The brokerage is particularly attractive for long term and retirement focused investors because of Fidelity’s accessible buy and hold strategy and goal building focus. Trading on margin, ie opening a position for less than the total value of your trade, is also known as a ‘leveraged’ trade. Bajaj Financial Securities Limited is committed to providing independent and transparent recommendation to its clients. Pick a stock and watch it for three to six months to see how it performs. Benefits: i Effective Communication ii Speedy redressal of the grievances. Apply these swing trading techniques to the stocks you’re most interested in to look for possible trade entry points. Bollinger Bands consist of three lines: a middle band usually a simple moving average and two outer bands that represent standard deviations from the average. Nikkesh Pal 30 Jan 2023. But please, read the sidebar rules before you post. Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. 24/7 dedicated support and easy to sign up. SEBI Registration No. If you’re not quite ready to be a prime time player, you can always try paper trading with a stock market simulator first. That said, online courses on the subject do exist. The market assumption for covered calls is a neutral to slightly bullish outlook.

Join the growing tribe of 5,00,000+ Appreciators

Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. By staying on our website you agree to our use of cookies. With Appreciate you can easily invest in US equities, fixed deposits, ETFs, bonds, digital gold, savings accounts and many more lucrative investment products at a very low cost to diversify your portfolio and enjoy higher returns. Obviously, before jumping into the best crypto app reviews, we must first distinguish what makes an app the best crypto app out there. Like any skill, proficiency in investing increases with time and experience. This largely depends on individual circumstances, risk tolerance, and expertise. Day trading requires constantly adapting to changing situations. The forex market is highly dynamic at all times, with price quotes changing constantly. Instead, most of the currency transactions that occur in the global foreign exchange market are bought and sold for speculative reasons. The securities you buy are maintained electronically in the demat account. PRECAUTIONS FOR CLIENTS DEALING IN OPTIONS. Experiment with different strategies in a demo account to find the one that suits your risk tolerance and trading style best. They’ll also set up larger scale, two minute buy or sell signals. In the general case, when using tick charts, it is better to stick to patterns that reflect basic supply and demand on a micro scale and the typical support, resistance, and breakout levels. By signing up, you agree to receive transactional messages on WhatsApp.

2 Which broker has the best mobile app?

Video shows my thought process as well as Confluences leading to the execution of a trade based on harmonics as well as the Beat the Market Maker Method BTMM. Normally, to find the best app specifically for you, you would have to go through numerous crypto app reviews. Login to your trading account through web app, mobile app, or desktop app. One of the lowest fees on the market. Key levels created by chart patterns allow traders to identify logical stop losses and profit targets – effectively defining a trade’s risk reward ratio. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. When you are an investor who is willing to accept the high level of risk associated with intraday trading you should do so; otherwise, positional trading offers significantly reduced dangers. Unlike day trading, swing trading does not require constant monitoring since the trades last for several days or weeks. I did really well at first I was up 163%. There are generally three groups of patterns: continuation, reversal, and bilateral. Com is an independent comparison platform and information service that aims to provide you with information to help you make better decisions.

Understand how futures trading works

To see an intuitive, comprehensive directory of highly regarded regulatory agencies, check out our Trust Score page. Brokerage will not exceed the SEBI prescribed limit. Seize your opportunities with cutting edge platforms built around your needs. Furthermore, the Financial Conduct Authority FCA in the UK has implemented policy statement PS20/10, which prohibits the sale, marketing, and distribution of Contracts for Difference CFDs associated with trading products. We hope that this guide has made algorithmic trading easier to grasp, and that we managed to convince you that algorithmic trading is the best trading form out there for traders who are serious about their trading. Step into the energy market with various options for trading oil and gas. Equiti Brokerage Seychelles Limited is authorised by the Financial Services Authority of Seychelles under license number SD064 as a Securities Dealers Broker. It identifies overbought and oversold conditions. The trading account shows the result of buying and selling goods. As the trade duration is small, a scalper trader must be quick when scalping in the stock market. The app includes basic research and charting, recent news, and the ability to enter a trade quickly. Swing Trading can also be done on the side as a part time job. Use limited data to select content. According to the Bank for International Settlements, the preliminary global results from the 2022 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets Activity show that trading in foreign exchange markets averaged US$7. Nonetheless, through the application of fundamental, technical, or hybrid analysis, one can determine when conditions are suitable for potentially successful scalping. Automate, integrate, customise. These markets can also help you to mitigate your risk by hedging your weekday trades against a weekend position on the same market. Investors can benefit from capital appreciation and dividends, with many creating long term wealth through their equities investments. Hey Jake, “hodling” is the usual term that’s used within the crypto space. With intuitive controls, engaging gameplay, and rewarding features, this game is sure to keep players entertained for hours. Swing traders will try to capture upswings and downswings in stock prices. The candlestick patterns cheat sheet presents single, double, and triple candlestick patterns and confirmation patterns, enabling traders to recognize signals for potential market reversals or continuations. Vyapar is India’s best accounting software for creating trade account formats. Here are some key points to keep in mind when getting started with cryptocurrency trading. You can deploy a range of options trading strategies, from a straightforward approach to intricate, complicated trades. 05, a one tick change would result in a $5. When directly compared with the 18 forex companies in our rubric, XTB stands out for its overall fee schedule, which is transparent and includes low trading fees, spread costs, and overnight financing rates, active trader discounts, no withdrawal or wire fees, and more.

Support

The Profit and Loss Account displays the company’s net profit or loss. One important term to understand is “trading tick. The three inside down candlestick pattern is a bearish reversal pattern which is formed at the top of the price chart. They study past, present, and future business and economic trends to provide data driven insights for business decision making. NASDAQ: ASTS just agreed to a deal with SpaceX and jumped in premarket trading. Today, we’ve journeyed through the dynamic world of swing trading, exploring the diverse strategies used by traders to capture short term profits in the stock market. Print on demand is a low risk way to create and sell merchandise. With detailed reports, customizable analysis, intuitive journaling, and an efficient calendar view, Tradervue offers everything you need for success in the financial markets. For more information, you can learn about day trading rules on FINRA’s website. Putting your money where your morals are: understanding ESG investing. Instantly react to trading opportunities Customize your platforms to receive notifications, manage positions, control risk, and monitor account profitability in real time. These expenses ensure the production process is smoothly done by fulfilling numerous production requirements. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. But one of the maxims of investments holds true in this case as well, the higher the reward, the higher the risk. As with most leading robos, you’ll be presented with a suite of premade portfolios that aim to match your risk tolerance and are stuffed with low cost funds. Share Market Timings in India. This pattern indicates a potential shift in market sentiment from bearish to bullish. Upstox, backed by leading personalities like Ratan Tata offers one of the top rated Upstox Pro Trading apps with easy to use interface. Any minute now I’ll jump in with pointless observations. While stock prices in the market on any day may fluctuate according to how many shares are demanded or supplied, over time the market evaluates a company on its business results and future prospects. This indicator best suits the high frequency option traders who bet on intraday moves. There are various types of charts like candlesticks, lines, bar charts etc. That’s not to say you should be conspiratorial, just that an app’s design can often tell you a lot about how a company treats its customers. It features advanced charting, trade tools, profit and loss calculations, a live CNBC news stream, and chat support where you can get live help from a TD Ameritrade trading specialist inside the app. A comfortable and responsive keyboard and mouse setup can make a significant difference in your productivity. However, you can trade the price of an asset going down too, called ‘going short’. Here are the basic steps to help you do this. With this method, a trader sells a shorter term call option while simultaneously buying a longer term call option with the same underlying commodity and time frame of the expiration date but a higher strike price. What is Gap Up and Gap Down in Stock Market Trading.

Reasons to buy

It’s also fair to mention that if you are familiar with the double top pattern, this is essentially the mirror image of that strategy. Luckily, we have integrated our pattern recognition scanner as part of our innovative Next Generation trading platform. Knowing how to read and analyze these common candlestick patterns helps you make informed trading decisions and minimize risks. These are often described as vanilla options. A price pattern that signals a change in the prevailing trend is known as a reversal pattern. An ascending triangle is a bullish continuation pattern characterized by a horizontal resistance line and an ascending support line. Nobody can predict a stock price accurately. Swing trading strategies involve taking advantage of short term price fluctuations in the market. You may already know people who sell their homemade jewellery screen printed shirts, scented candles, soaps or wood crafts. But just because you can doesn’t mean you should. ETRADE does not allow clients to buy fractional shares but does offer paper trading on its advanced trading platform, Power ETRADE, at no cost. To get a better idea of the costs of trading, consider opening a demo account. Call +44 20 7633 5430, or email sales. Because the book delves a bit deeper into the technical aspects of options pricing, veteran traders will get more out of the material than novices. And better yet, you get tax relief on your contributions, which means free money from the government on any money you add into the account, all added automatically by your investment platform. What are Futures/ Futures Contracts. Manual order placement involves delays and may be error prone and stressful. And unlike some of the free app based investment platforms, Webull offers traditional and Roth IRAs.

Educational resources

Find him on: LinkedIn. Even though there’s no thumb rule for that, still it’s crucial if you strategize and keep an eye on the best time. It signals a potential trend reversal from bearish to bullish. Corporate Office: Bajaj Financial Securities Limited, 1st Floor, Mantri IT Park, Tower B, Unit No 9 and 10, Viman Nagar, Pune, Maharashtra 411014. A trading strategy outlines the investor’s financial goals, including risk tolerance level, long term and short term financial needs, tax implications, and time horizon. In other words, start conservatively, even though this might be going somewhat against the nature of many aspiring traders. Take self paced courses to master the fundamentals of finance and connect with like minded individuals. The discipline developed in simulated trading transitions well into managing emotions when actual money is on the line. EtoroCFDrisk % of retail CFD accounts lose money. We offer over 13,000 popular financial markets. IG also employs robust security protocols, such as SSL encryption and two factor authentication, to protect clients’ personal information and funds. Risk management in stock trading. Understanding how they work can help you calculate the risk involved with each of the variables that affect option prices. Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers. But don’t just sign up with any stock broker. This motto suggests that it can be better to trade on price action before an announcement rather than simply waiting for the announcement. The article was reviewed, fact checked and edited by our editorial staff prior to publication. Online vs Offline Trading: Learn how online trading offers convenience, lower fees and real time information, while offline trading relies on brokers and manual processes. Accountants and bookkeepers ride shotgun on thousands of startups. When Super Traders Meet Kryptonite. Securities and https://pocketoption-ru.online/ Exchange Commission. If you take Netflix for instance, their share price has reached over $600. Oh one on other thing, I use this on iPad Pro 2020, on when the charts are expanded to full screen it’s difficult to change the time frame when it’s around 30 4h it’s difficult to activate the scrolling since it has that dock bar overlapping it. The role of a demat account is to store shares electronically, and a trading account is to enable buying and selling of shares in the stock market. You can learn more about trading by taking online courses on IG Academy – for free. The only catch is that it doesn’t allow for DIY stock trading; it primarily uses ETFs. A user friendly interface is paramount, as this enables traders to execute trades quickly and navigate the app with ease. Technical analysis is the study of past price and volume patterns on charts to predict future price movements.

Platforms

Experts recommend consulting a tax professional to understand the implications for your situation. For example, the EUR/USD would be a currency pair for trading the euro against the U. Review the Characteristics and Risks of Standardized Options brochure before you begin trading options. After all, it is one of the most popular crypto giants out there. Factors contributing to these dismal outcomes include high transaction costs, emotional decision making under pressure, and the inherent unpredictability of short term market movements. Everything is clearly laid out and easy to operate. Day traders can choose stocks that tend to move a lot, either in dollar terms or percentage terms. We usually consider these very bullish candlesticks in that bulls were in control during the entire time interval. © 2024 The New Indian Express. The MACD consists of two moving averages – the MACD line and signal line – and buy and sell signals are generated when these two lines cross. You can research stocks after that and pick a brokerage to begin your first trades. Such as the ability to combine multiple portfolios, live charting, and much more. In the world of online trading, finding the most trusted.

Grow your money systematically every month for constant wealth creation

You can think of this strategy as simultaneously buying one long put spread with strikes D and B and selling two short put spreads with strikes B and A. That means, if you buy options then you just stand a 4% chance of making money on options. No commission on mutual fund investments. The sole withdrawal option is to convert cryptocurrencies into USD. Some brokers offer access to U. So it is in the market. Some of these additional factors include tariff rates and quota, protectionist policies, trade barriers and taxes, economic depression and agricultural overproduction, and impact of protection on trade. The closing stock was valued at $32,000. Written by Sam Levine, CFA, CMT, Blain ReinkensmeyerEdited by Carolyn KimballFact checked by Steven Hatzakis. That said, traders will find Webull’s app based capabilities to be impressive. Traders can use technical and fundamental analysis tools to help confirm breakout signals and minimize the risk of false or failed breakouts. Try a Free Demo Open a Live Account. There are a number of risks associated with trading. Does paper trading make you money.

Insurance

Since scalpers make frequent trades, the costs associated with commissions spreads, and slippage can add up quickly and eat into profits. A special memorandum account SMA is a brokerage account that is set up in conjunction with a margin account to hold excess margin that is, more than is needed to meet maintenance requirements from the margin account. This course will develop the Knowledge of basics of the Indian derivatives market covering Equity Derivatives, Currency Derivatives and Interest Rate Derivatives. Traditional brokers levy percentage based brokerage, proportional to the trade volume, which increases the brokerage costs if you trade more often. The volume of Trades: The trading app enables traders or investors to quickly execute big volume deals and quickly profit from their investments. As cryptocurrencies are very volatile, lots tend to be very small: most are just one unit of the base cryptocurrency. This disciplined approach weaves success not just into the fabric of transactions, but also into the trader’s mental and strategic fiber. Update your mobile numbers/email IDs with your stock brokers/Depository Participant.

Share Market

Understanding Buying Call vs. Scalpers are generally attempting to continuously buy the bid and sell the ask. Happy gaming and earning with FastWin. Combining any of the four basic kinds of option trades possibly with different exercise prices and maturities and the two basic kinds of stock trades long and short allows a variety of options strategies. If there is one thing you should know about trading, it is that nothing ever will become perfect. Who should practice intraday trading. Reg Office: Bajaj Auto Limited Complex, Mumbai –Pune Road Akurdi Pune 411035. We’ll review and compare them based on the factors that are most important to traders. Below are some essential bilateral trading patterns. This reduces the risks of losing all your money on one or a series of bad trades while you’re still learning. Instead of letting emotion dictate whether to keep a position open, quants can stick to data backed decision making. It’s easy to use, pleasing to the eye, and super convenient for Ledger device users. Manually go through historical charts to find entry points that match yours. You can minimize your risk by spreading your crypto purchases across multiple exchanges. Very often, brokerages offer two in one accounts that involve Demat and trading accounts. This cutting edge technology in trading has revolutionized how pattern indicators are used by equipping traders with the tools to swiftly decode complex chart patterns. Releases of economic data, such as the non farm payroll report, gross domestic product GDP figures, and interest rate announcements, have an impact on commodity prices. Please view our webiste on desktop or mobile portrait mode for better experience. More seasoned or risk tolerant traders may be comfortable with 50:1 or 100:1+. See our methodology for more information on how we made this list. Support refers to the level at which an asset’s price stops falling and bounces back up. Understand audiences through statistics or combinations of data from different sources. At the forefront of this is the ability to earn interest on your cryptocurrency holdings that otherwise – would be sat idle in your private wallet. “Day Trading: Your Dollars at Risk. There are discount brokers and full service brokers. Any articles, daily news, analysis, and/or other information contained in the blog should not be relied upon for investment purposes. Computing the net income for the period. Ideally, what you will want to see is a series of higher lows forming in the stock. Informal stock markets started mushrooming in various European cities.

Get up to 200 USDT bonus

Put a stop loss order: One of the prudent intraday trading techniques involves setting up a stop loss order for every trade. Don’t hesitate to tell us about a ticker we should know about, market news or financial education. We find the demo account to be quite lacking in terms of depth and analysis, and this seems to be a deliberate ploy on eToro’s part to lock a lot of the platform’s potential behind a full, real account. A falling wedge occurs when the price is moving down, and the highs and lows of the price action converge to form a triangle or wedge shape. Bank services provided by Evolve Bank and Trust, member FDIC. Our dedicated support team is here to safeguard your investments, guiding you through the markets with confidence. Create profiles for personalised advertising. Buy cost calculator to accurately assess the costs of developing a professional grade quantitative trading platform. Regular trading can involve holding positions for days, months, or years, while intraday trading requires closing positions within the same trading day. Turbulent emotions could become a liability if they lead to rash decisions, especially during periods of high volatility. Rarely, an investment app will let you trade mutual funds. The Company Has Provided Many Different Types Of Games Within This YosWin Platform, Offering You A Diverse Range Of Gaming Options To Choose From. How do I choose the right online trading platform for me. They can use the buy first and sell later approach or go for a sell first and buy later strategy. In this comprehensive guide, we’ll review and compare the top online brokers and trading platforms available to European investors in 2024. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Here are some of my top tips for mastering the puzzles in this game. Check out the Options Strategy Builder for more examples and help. As you can see, this highlights the biggest imperfection of tick charts – you can’t get the entire picture of the trading activity. Machine learning algorithms analyse vast datasets to identify patterns and guide trading decisions. 14 points, and the biggest one day point decline, 998. Schwartz’s storytelling sheds light on the excitement, trading setbacks, and pivotal moments that shaped his career. Between 51% and 89% of retail investor accounts lose money when trading CFDs. Block deal window open time: 8:45 a. Learn what day trading is, how it works, strategies to succeed, and essential tips to start trading. A desk trader is someone in the financial industry that buys or sells investments for their clients.